One Payment. One Plan.

One Step to Reset Your Financial Future.

Consolidate high-interest debt into one simple monthly payment—

and focus on what’s next.

Borrow up to $60,000 with rates as low as 4.74% APR.*

A Simple Way to Move Forward

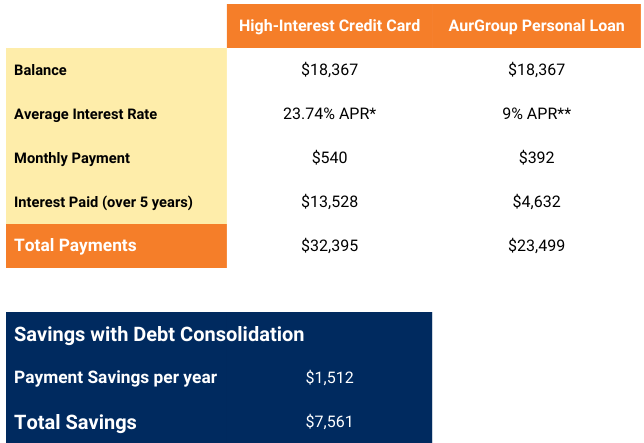

When multiple balances start to feel overwhelming, simplifying them can make a real difference. With an AurGroup One Payment Personal Loan, you can consolidate high-interest debt into one clear plan—so you can reset your finances and focus on what’s next. Take a look at this example and look at the savings each year and over time.

*Statistics of average credit card rate as of June 2, 2024. APR=Annual Percentage Rate. **This example assumes a fixed rate of 9% (with autopay or payroll deduction payments with Direct Deposit and an AurGroup checking account), and is based on prime credit and a 60-month term. Our rates may be higher or lower based on credit score and term. The credit card rate is based on an average of various sources and assumes that the borrower doesn’t take on any more credit card debt during the same period used in the example. Both calculations assume 60 total monthly payments and no pre-payment amounts, late payment fees, or penalties.

Using our One Payment Personal Loan to pay off debt can give you:

✅ One Monthly Payment

Bring credit cards and other higher-interest balances together into one manageable loan.

✅ Rates as Low as 4.74% APR*

Save money with competitive rates designed to help you move forward.

✅ Borrow Up to $60,000

Flexible loan amounts to meet your needs.

✅ Clear Payoff Timeline

Know exactly when your debt will be paid off.

✅ Local Team, Real Support

Get guidance from real people who understand your goals.

Are You Ready to Take the Next Step?

The One Payment-One Plan Personal Loan rates start as low as 4.74% APR. Rates are subject to credit history and the loan term. The rate shown reflects a 0.25% discount for automatic payment with an AurGroup checking account. All loans are subject to credit approval. The One Payment - One Plan Loan Special excludes loans already financed with AurGroup—no refinances or modifications permitted. The minimum loan amount is $5,000 for terms up to 48 months or $10,000 for longer terms up to 84 months, with a maximum loan amount of $60,000. Limited-time offer. Additional restrictions may apply.